Corporate Finance

Corporate finance bij Newtone: samen op weg om uw ambities waar te maken. Met vertrouwelijkheid voorop en met oog voor de emoties waarmee ieder traject gepaard gaat. En toch steeds onverminderd scherp. Wat uw doel ook is, onze corporate finance specialisten begeleiden u gedurende het gehele proces.

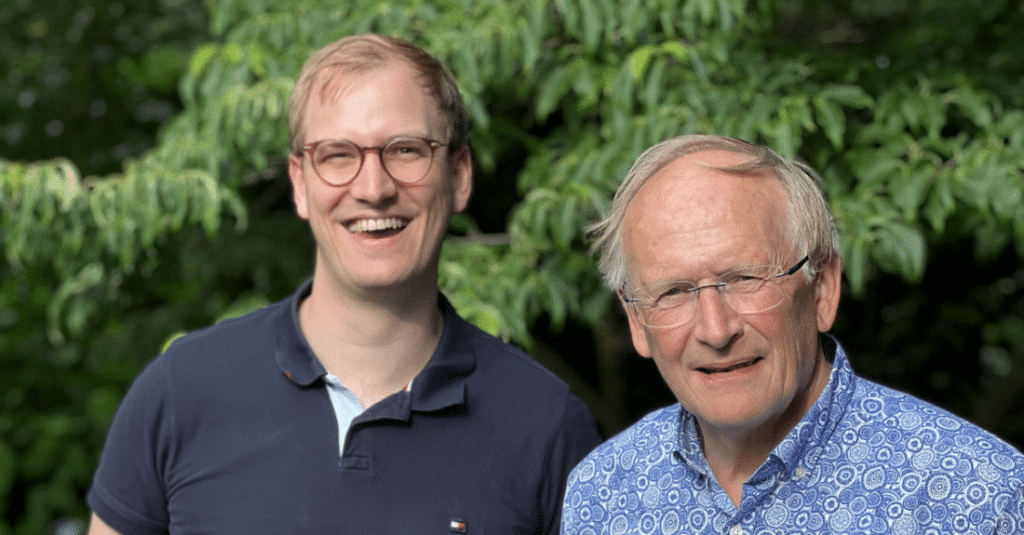

Corporate Finance adviseurs

Onder corporate finance vallen onze diensten, gericht op bedrijfsopvolging, overname, verkoop en financiering. De financiële aspecten zijn hierbij enorm belangrijk. Goede begeleiding is dan ook essentieel.

Ons corporate finance advies richt zich op uw ambities

Bij Newtone wordt u actief begeleid door ervaren specialisten. Denk hierbij aan het voorbereiden op een verkoop van uw onderneming, het participeren van werknemers, een begroting opstellen, bedrijfsovernames, due diligence en financieringsvraagstukken. We weten wat de deal verder brengt, en de drijfveren erachter. Bovendien kennen we de bijbehorende risico’s die – vaak onbedoeld – bij elke deal horen. Onze experts kunnen u bij elke stap in het proces bijstaan. Met ons team van ervaren bedrijfstaxateurs (business valuators), financiële professionals, belastingadviseurs en juridische experts staan wij klaar om u bij elke stap bij te staan.

We kunnen uw transactie niet risicovrij maken. Maar we kunnen u precies vertellen welke risico’s er zijn en hoe u deze kunt minimaliseren. En daarbij kunnen wij u adviseren hoe u uw fiscale positie kunt optimaliseren. Zoals we voor zoveel van onze cliënten hebben gedaan. Nationaal én internationaal.

Services binnen corporate finance

Bekijk hieronder onze volledige corporate finance dienstverlening.

Wet- en regelgeving

Wet en regelgeving met betrekking tot corporate finance

Wij snappen als geen ander dat u constant te maken krijgt met (veranderende) wet- en regelgeving. Wij kijken samen met u naar de actuele situatie.

Onze specialisten staan vandaag al voor u klaar.

Kennis

Blikverruimende artikelen en inzichten

Blijf op de hoogte dankzij de inzichten van onze specialisten. Lees nieuws en blogs over corporate finance die nieuwe invalshoeken bieden op actuele onderwerpen.